Sendible insights 10 Essential Tools for Insurance Agents to Boost Productivity in 2026

With the right tools for insurance agents, they can transform how you work, saving time while improving client outcomes and generating more leads.

In this comprehensive guide, we explore the top 10 essential tools for insurance agents that address real challenges.

We’ve included social media management, client communication, lead tracking, and other solutions. Whether you're an independent agent or part of a larger brokerage, these insurance agent productivity software tools will help you work smarter, not harder.

Insurance agent software tools: Quick overview

Insurance agents juggle multiple roles — sales, customer service, compliance, and marketing. The right tools can transform how you work, saving time while improving client outcomes and generating more leads.

A tool like Sendible that is built for agencies focuses on the issues at hand: overseeing multiple agent profiles, distributing pre-approved content, and maintaining one brand voice across profiles and platforms.

Scalable and compliant social media for insurance agencies.

Table of Contents

- Why do insurance agents need specialised productivity tools?

- What are the best social media tools for insurance agents?

- 1. Sendible: Best all-in-one social media management for insurance teams

- Which CRM and AMS software should agents use for better lead tracking?

- 2. HubSpot (CRM)

- 3. AgencyBloc (Life/Health)

- 4. Applied Epic (P&C)

- How to handle quotes and policy management as an insurance agent?

- How can insurance agents automate content creation?

- 5. Canva

- 6. Jasper or Copy.ai

- 7. CapCut

- Essential communication and e-signature tools for faster closing

- 8. DocuSign

- 9. Calendly

- 10. Loom

- How do I manage social media compliance as an insurance agent?

- Conclusion: Building a tech stack that works for you

Why do insurance agents need specialised productivity tools?

Insurance agents are expected to be sales professionals, customer service experts, compliance officers, and marketing specialists, all at the same time. The challenging insurance landscape demands efficiency without compromising on the personal touch that builds trust with clients.

Every insurance professional and firm is dealing with the "Compliance vs. Speed" challenge.

Every social media post, email campaign, and client communication must adhere to strict regulatory standards, yet clients expect immediate responses and seamless digital experiences.

Manual processes simply cannot keep pace.

This is where specialised insurance tools become invaluable.

Agency Management Systems (AMS) have evolved beyond basic record-keeping to become central hubs for policy management.

Customer Relationship Management (CRM) platforms now integrate with marketing automation to create seamless client journeys. The shift towards digital-first client experiences means agents need tools that can handle everything from initial social media engagement through to e-signature collection; all while maintaining compliance.

The average insurance agent juggles approximately 10 to 15 different software applications throughout their working day. This fragmentation leads to lost productivity, missed opportunities, and compliance oversights. By implementing a carefully selected suite of insurance agent tools, you can reduce this complexity while actually expanding your capabilities.

Insurance social media content calendar.

What are the best social media tools for insurance agents?

Social media has evolved from an optional marketing channel to an essential lead-generating, trust-building, and customer-centric touchpoint for insurance agents.

Potential customers research agents online before ever sending an email, message, DM or phoning, and your social media presence often forms their first impression. However, managing multiple platforms while ensuring every post meets compliance standards presents a significant challenge.

For insurance professionals, generic social media tools often fall short. You need platforms specifically designed to handle the unique requirements of regulated industries, where you need the following:

- Approval workflows

- Content archiving for regulatory review

- Team collaboration features that allow compliance officers to review posts before publication.

1. Sendible: Best all-in-one social media management for insurance teams

Sendible stands out as the market-leading social media management solution for insurance agencies.

Unlike generic scheduling tools, Sendible was built with teams and compliance-heavy sectors in mind, making it an ideal fit for insurance professionals navigating strict regulatory requirements.

Key benefits include:

- Centralised dashboard: Manage Facebook, Instagram, TikTok, Threads, LinkedIn, and other channels from one intuitive interface, saving insurance agents (or their marketing people) 10 to 12 hours per week. Social media agencies or freelancers can handle all of this for you, coordinating with yourself or a centralised marketing team (agencies can even use Sendible white label, to ensure that insurance agents are getting the best possible tool).

- Advanced scheduling: Plan and automate content across all social media channels, maintaining consistent engagement without daily manual posting.

- Approval workflows: Route posts through compliance officers or agency principals before publication, ensuring regulatory compliance.

- Centralised inbox: Client queries from Facebook Messenger, Instagram DMs, and LinkedIn messages all appear in one location, the Priority Inbox. This dramatically speeds up response times.

- White-label reporting: Track engagement rates, follower growth, and lead generation metrics with professional, branded reports.

Why use this? Make it easier to manage dozens or hundreds of social media profiles, stay compliant, collaborate, schedule, and leverage AI creation tools.

💡 Need ideas for social media content pillars for insurance agents? Here’s a list of content pillars for insurance agents.

One idea is creating a "Myth vs. Fact" Instagram Reel debunking common insurance misconceptions.

Using Sendible, you can schedule this content, create platform-specific variations (a LinkedIn carousel with the same information for professional audiences), route everything through compliance approval, and track engagement — all from one dashboard.

Get better at social media for insurance agents: Get Sendible today. From scheduling to reporting—manage everything in one place, build engagement, and grow your insurance brokerage.

Which CRM and AMS software should agents use for better lead tracking?

The foundation of any successful insurance practice is knowing your clients and prospects inside out.

CRM and AMS software doesn't just store contact information — it creates a complete picture of each relationship, tracks every interaction, and ensures no opportunity gets overlooked or forgotten.

2. HubSpot (CRM)

Why use this? Handle sales leads more efficiently.

HubSpot is a favourite amongst insurance agents for its powerful yet accessible CRM functionality. It excels at tracking leads from initial contact through to policy purchase and beyond.

When a prospect engages with your social media content, comments on a Facebook post, or downloads a guide from your website, HubSpot captures this activity and automatically updates their contact record.

Its marketing automation features allow you to nurture leads with personalised email sequences, gradually building trust before you make personal contact.

3. AgencyBloc (Life/Health)

Why use this? Make it easier to manage life and health insurance policies.

Known as the go-to AMS for life and health insurance agents. This specialised platform offers features specifically designed for commission tracking, policy renewals, and client lifecycle management.

AgencyBloc handles the complex relationships inherent in health insurance — family policies, employer groups, and Medicare Advantage plans all require different management approaches.

4. Applied Epic (P&C)

Why use this? A complete AMS for P&C insurance.

The industry standard for property and casualty agents. Applied Epic manages everything from commercial lines to personal auto policies, with sophisticated rating capabilities and carrier integrations that streamline quoting.

Its document management system ensures all policy documents, endorsements, and client communications remain organised and accessible.

The true power emerges when these platforms integrate with your marketing efforts.

A lead generated through a LinkedIn article you shared via Sendible enters HubSpot, receives automated nurturing emails, gets scored based on engagement, and — once qualified — transfers to your AMS with complete context.

In 2026, AI-powered CRM tools will provide actionable insights to optimize workflows, improve sales performance, and personalize client interactions. Automation features save time by handling repetitive tasks such as appointment scheduling and data entry, allowing agents to focus more on selling.

How to handle quotes and policy management as an insurance agent?

Insurance agents need to provide fast, accurate quotes and manage policies efficiently. Modern quote software enables agents to generate professional, and error-free quotes in minutes. These often include comparison features that make it easy to analyse policies from multiple insurance carriers.

An advanced Agency Management System (AMS) not only stores policy details and tracks client interactions, but also automates repetitive tasks such as renewals, reminders, and document management. This reduces manual data entry and administrative workload, freeing up more time for agents to focus on building relationships.

Comparison tools further enhance the agent's ability to deliver value by providing side-by-side analysis of coverage options, premiums, and benefits from different insurance carriers. This transparency builds trust and positions the agent as a knowledgeable advisor.

Get better at social media for insurance agents: Get Sendible today. From scheduling to reporting—manage everything in one place, build engagement, and grow your insurance brokerage.

How can insurance agents automate content creation?

Content creation represents one of the most time-consuming aspects of modern insurance marketing, yet it's essential for building authority and attracting prospects. The solution isn't to create less content. It's to create smarter content, using SaaS tools with AI features for insurance agents designed to maximise efficiency.

5. Canva

Why use this? Design whatever you need when you need it without being a graphic designer.

Canva has revolutionised visual content creation for non-designers with thousands of templates specifically tailored for social media. The Brand Kit feature proves particularly valuable.

Simply upload your agency logos, brand colours, and fonts once, and every design automatically maintains brand consistency. Create infographics to visualise complex insurance concepts in minutes or professional "Meet the Team" posts that make your agency look polished.

Take a look at our Canva integration: Create, get approved, and scheduled all in a few clicks.

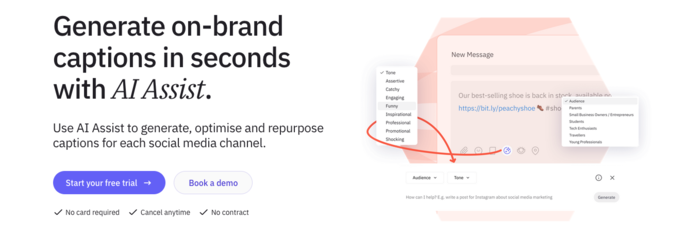

6. Jasper or Copy.ai

Why use these? Generate 1st drafts you can use for social, articles, and email marketing.

AI writing assistants like Jasper can generate first-drafts of social media captions, blog post outlines, and email content at remarkable speed.

However, insurance agents should always review and edit AI-generated content for compliance. Only use these tools as starting points.

Pro Tip: Use AI to generate content, but not all of it. 60% of P&C insurers now use AI to draft social content, but the most successful agencies use a "human-in-the-loop" approach, leveraging an AI writing assistant, to maintain authenticity (Source: Guidewire 2026).

7. CapCut

Why use this? Editing short-form videos for Instagram, TikTok, and other platforms has never been easier.

Addresses the growing importance of short-form video content. With Instagram Reels, TikTok, and LinkedIn video posts driving significant engagement, insurance agents can no longer afford to ignore video.

CapCut makes video editing accessible, even for complete beginners, with templates, transitions, and effects.

The productivity multiplier:

Start with a single comprehensive blog post titled "Understanding Your Insurance Policy." You can create one this way:

- Use AI tools to generate social media captions highlighting key points.

- Create infographics in Canva visualising coverage components.

- Record a short Loom video explaining the most confusing aspects.

- Edit the video into 30-second snippets using CapCut for Instagram Reels.

- Schedule everything through Sendible.

One piece of pillar content becomes five to seven distinct touchpoints, all created in a fraction of the time it would take traditional methods.

Essential communication and e-signature tools for faster closing

The final stages of the sales process — proposal presentation, application completion, and policy binding — historically involved significant back-and-forth, printed documents, and frustrating delays.

Modern insurance agent tool solutions have transformed this experience, allowing you to move from quote to bound policy in hours rather than days.

8. DocuSign

Why use this? Get customer signatures quickly, easily, 24/7.

Offers legally binding e-signature capabilities with robust audit trails that satisfy regulatory requirements. Clients receive applications electronically, sign from their smartphone whilst the conversation is fresh, and return documents instantly.

The platform's mobile optimisation proves crucial — when a client decides they want to proceed with a policy at 8 PM whilst reviewing your proposal, DocuSign allows them to sign immediately.

9. Calendly

Why use this? Quicker booked calls with prospects.

Solves the endless "When are you available?" email tennis. Simply send your Calendly link. Prospects see your actual availability, select a time that suits them, and the appointment automatically appears in your calendar with reminder notifications sent to both parties. The question feature allows you to gather essential information before the conversation begins.

10. Loom

Why use this? A-sync communications with sales prospects. Explain what they don’t understand without waiting for booked calls.

A game-changing tool for explaining complex insurance concepts. Rather than typing lengthy emails, record a three-minute Loom video walking through a sample scenario.

A practical multi-tool client communication scenario:

After a successful consultation, send a DocuSign link to the application, along with a Loom video summarising what you discussed and outlining next steps. Include your Calendly link for the policy delivery appointment.

An easy, frictionless, multi-touch approach demonstrates professionalism, keeps the sales lead moving forward, and significantly improves closing rates.

How do I manage social media compliance as an insurance agent?

Social media compliance represents one of the most significant concerns for insurance professionals. Regulatory bodies scrutinise agent communications, and social media posts are subject to the same compliance requirements as traditional advertising. Violations can result in substantial fines, license issues, and reputational damage.

Sendible's compliance solutions:

- Approval workflows: Before any content goes live, it’s routed through designated approvers — typically a compliance officer or an insurance agency owner who’s very familiar with regulatory requirements.

- Content library: Create a collection of pre-approved posts that can be scheduled repeatedly without requiring fresh approval each time.

- Archiving capabilities: Sendible automatically archives all published content, creating a searchable record of what you posted, when you posted it, and who approved it.

Best practices:

- Create guidelines specifying what types of claims can be made and what disclosures must accompany certain content.

- Train all team members with posting access on compliance standards. Even if an agency is doing this, they should know what can or can’t be posted.

- Appoint a dedicated compliance reviewer for social media content.

- Remember that compliance doesn't mean boring content; you can still share engaging posts within regulatory boundaries.

- Pro Tip: Use AI to generate content, but not all of it. 60% of P&C insurers now use AI to draft social content, but the most successful agencies use a "human-in-the-loop" approach, leveraging an AI writing assistant, to maintain authenticity (Source: Guidewire 2026). Sendible also has an insurance specific social media AI agent that could help generate ideas, explain complex policies, and scale your brand.

Get better at social media for insurance agents: Get Sendible today. From scheduling to reporting—manage everything in one place, build engagement, and grow your insurance brokerage.

Conclusion: Building a tech stack that works for you

The insurance industry has transformed dramatically, and agents who embrace appropriate technology will thrive whilst others struggle. However, the keyword is "appropriate" — accumulating dozens of disconnected tools creates more problems than it solves.

Build your tech stack strategically, prioritising integration:

- Your social media management platform should feed into your CRM

- Your CRM should integrate with your AMS

- Your e-signature solution should automatically log completed documents in your AMS.

For most insurance agents, a core stack might include Sendible for social media management, HubSpot for CRM and marketing automation, an industry-specific AMS (AgencyBloc or Applied Epic, depending on your lines), Canva for content creation, DocuSign for signatures, Calendly for scheduling, and Loom for video communication.

The investment in quality insurance agent productivity software pays dividends quickly. Time saved on administrative tasks gets redirected towards revenue-generating activities. Improved lead tracking increases conversion rates. Better communication enhances client satisfaction and retention. A professional social media presence attracts more prospects.

In this challenging market, the insurance agents who will dominate in 2026 and beyond aren't necessarily the ones working the longest hours — they're the ones working with the right tools.

Get better at social media for insurance agents: Get Sendible today. From scheduling to reporting—manage everything in one place, build engagement, and grow your insurance brokerage.

Freya Laskowski

Freya is an SEO consultant that helps brands scale their organic traffic with content creation and distribution. She is a quoted contributor in several online publications, including Business Insider, Fox Business, Yahoo Finance, and the Huffington Post. She also owns CollectingCents- a personal finance blog that she grew from the ground up.

You can reach out to her at freya@collectingcents.com

Text copied!